Switzerland’s premier lender and known Apple Pay holdout now permits its consumers to use Apple’s contactless payment system.

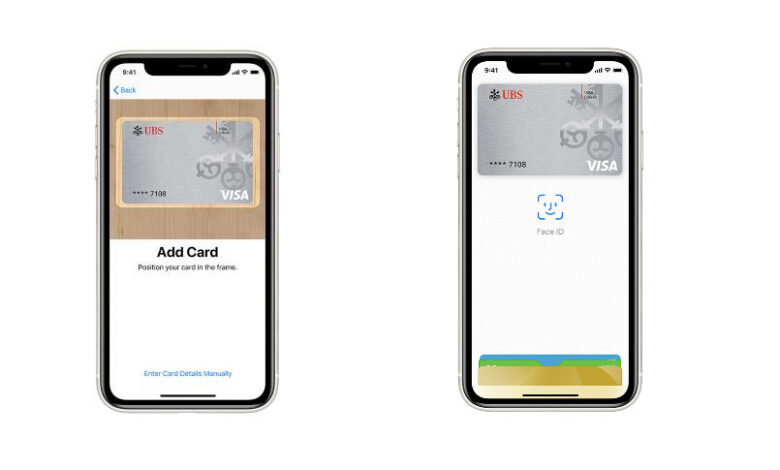

On Wednesday, UBS announced that its buyers would now be capable to use Apple Pay out. The announcement was created on both of those Twitter and Fb, and details out that users will be able to use the provider with both credit history cards and prepaid cards.

In April, the bank experienced introduced that Apple Shell out assist would be “coming quickly,” while it really is very likely that the ongoing coronavirus pandemic induced a delay in the program’s launch.

Apple Spend saw gradual adoption between the Swiss banking business, right until their boycott and reliance on a single mobile shell out solution guide to antitrust investigations. Starting in 2016, Swiss financial institutions little by little begun shifting away from “Twint,” their residence-developed cellular payment system of selection, and allowed Apple Fork out for their customers. Most of the major financial institutions had adopted Apple’s service, with UBS staying the exception.

Apple Fork out introduced in 2014 as a contactless payment process for Iphone, and was presented as a rapidly and simple way to fork out for factors at the sign-up. It later arrived to Apple View once introduced in 2015, to further more simplify payments. By 2016 Apple experienced introduced Apple Pay out to the website, which authorized end users to spend utilizing their Observe in tandem with their Mac, or Contact ID on Touch Bar enabled MacBook Pros.